Overview

Online installment loans offer quick funds to help cover immediate expenses. Repaid in a predictable series of payments, online installment loans may feature a quick online application process, without a credit check. Apply online now.

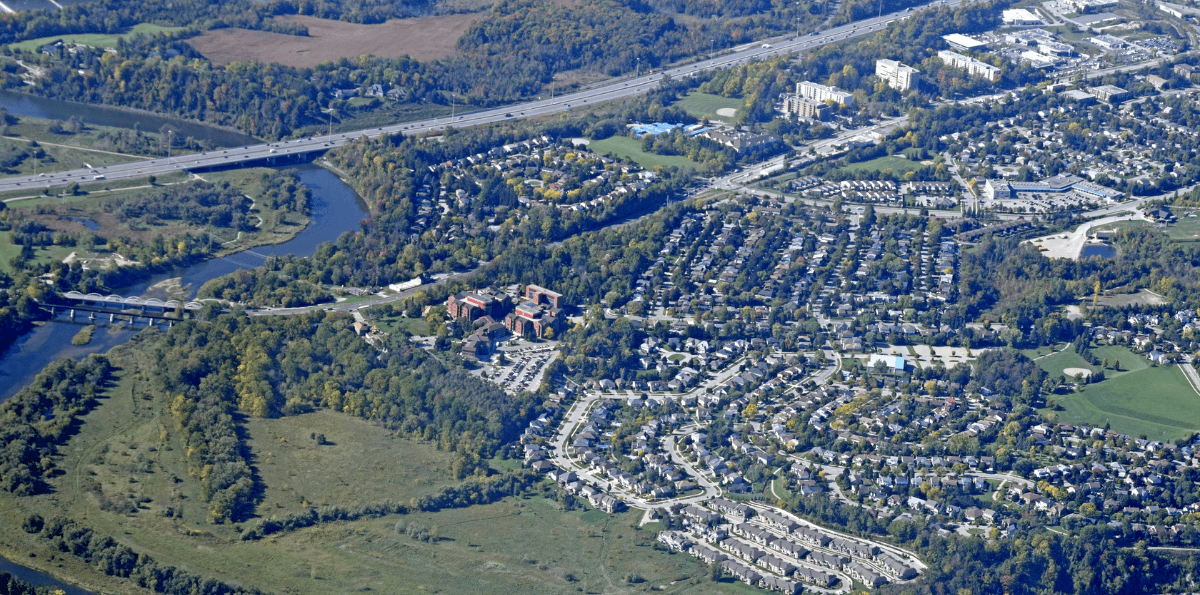

While Waterloo boasts a strong technology sector, it has been dealing with a powerful cost-of-living and housing crisis. Online installment lenders may offer alternative borrowing options, so Waterloo residents can obtain funds to help close a gap in cashflow.

Online Installment Loans in Waterloo: Who Can Benefit?

Subprime and near-prime borrowers may not qualify for mainstream financial products and services. Online installment lenders step in with alternative borrowing options and more flexible lending requirements.

In the next section, we’ll review common lending requirements.

Online Installment Loans – Common Requirements

It may be easier to qualify for online installment loans due to more flexible requirements. Let’s review some common requirements lenders may have for borrowers:

- You must be at least 18 years of age or older.

- You must be a Canadian citizen/permanent resident.

- You must have a consistent and reliable source of income.

- You must have a permanent address.

- You must have a valid Canadian bank account, active for at least 90 days.

If you meet the above criteria, you may be more likely to qualify.

In the next section, we’ll look at the pros and cons of online installment loans.

Pros of Online Installment Loans

- Fast access to funds. You may get funds deposited into your bank account in as little as 24 hours!

- No credit check during the online application process. This may allow subprime and near-prime borrowers to qualify for online installment loans.

- A simple and quick online application process. It only takes a few minutes to apply.

- No need for in-person appointments. This allows for a quick and convenient process.

Cons of Online Installment Loans

- Due to the higher credit risk, higher interest rates and fees may be necessary to offset the risk.

- Missed or late payments may result in additional charges.

In the next section, we’ll review five tips to improve your credit score in 2025.

5 Tips to Improve Your Credit Score in 2025

While the ongoing cost-of-living and housing crisis is extremely challenging, improving your credit score may be possible in 2025. Use the following brilliant strategies to help improve your credit score:

- Sign up for Credit Verify. You will be able to monitor your credit health and automatically detect mistakes on your credit report.

- Keep your credit utilization ratio below 30%.

- Pay your bills on time. This may have the largest impact on your credit score.

- Dispute errors on your credit report.

- Learn about the factors that affect your credit score e.g. your payment history, credit utilization ratio, and more.

Adhering to these tips may help you improve your credit score in 2025. Maintain a patient and persistent attitude.

In the next section, we’ll look at five tips to improve your financial situation in 2025.

5 Tips to Improve Your Financial Situation in 2025

Despite the ongoing crisis in Waterloo, there may be ways to improve your financial situation in 2025. Let’s review smart tips to improve your financial situation in 2025, in spite of the cost-of-living crisis:

- Increase your income. Earn online certifications to qualify for higher-paying jobs.

- Use the snowball method to pay off your debts. Start with the smallest debt.

- Budget effectively. Consider the zero-based budget, which has you assign a purpose to every single dollar of your income.

- Lower optional expenses e.g. going out for coffee or dining out.

- Take on a part-time gig or side hustle to supplement your income.

Following these tips may help you achieve a better financial outcome in the long term.

Final Thoughts

Waterloo residents are dealing with a major cost-of-living crisis, like most Ontarians. If you need quick funds, apply for an online installment loan via OntarioCASH. We don’t check credit scores or credit reports during the simple and quick online application process. Funds may be e-transferred to your bank account in as little as 24 hours!